Building A Fintech Disruptor With Anita Koimur, COO And Founder Of LiveFlow

Anita Koimur shares how she helped build fianance automation company LiveFlow from scratch to VC-backed start-up poised to shake up the sector.

We bring together a dynamic network of CFOs and senior finance executives, offering exclusive peer connections, the pulse with expert-driven editorial content, and cutting-edge technology resources.

Our weekly newsletters, research and interviews give you that insider's strategic edge on all the biggest issues you face.

Exclusive, vibrant member community of 2,500+ CFOs and finance leaders offering powerful peer insights & support.

Attend high impact in-person and online programs at the local and national level, led by industry thought leaders.

NASBA-approved CPE events and certification programs to meet requirements and advance your career.

Insights

The latest news on all the right trending topics to give you that edge.

Anita Koimur shares how she helped build fianance automation company LiveFlow from scratch to VC-backed start-up poised to shake up the sector.

One characteristic is critical, says Charlotte Colhoun, Group CFO of Vista Global.

CFO Lee Tsukroff shares the transformations redefining consumer wellness, and leadership in health and nutrition.

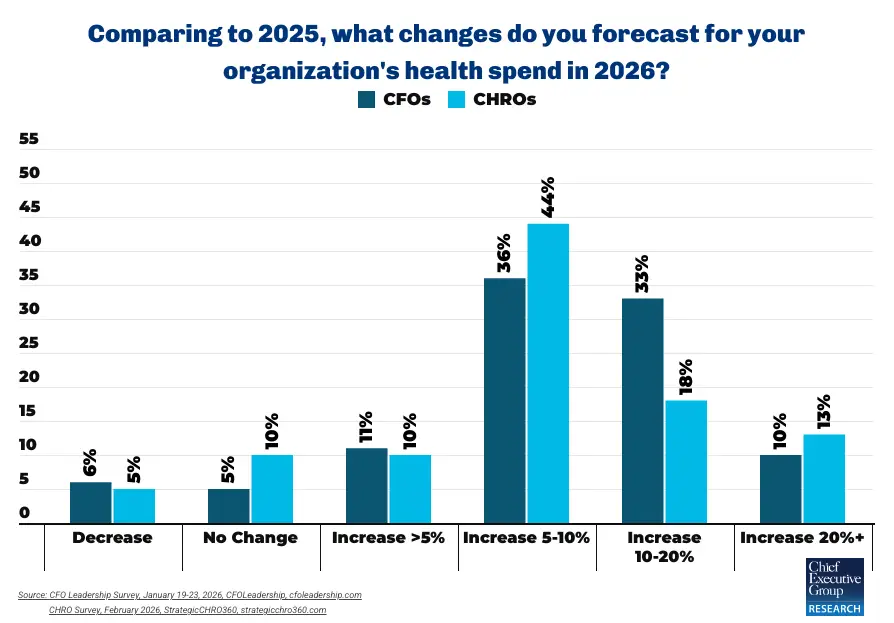

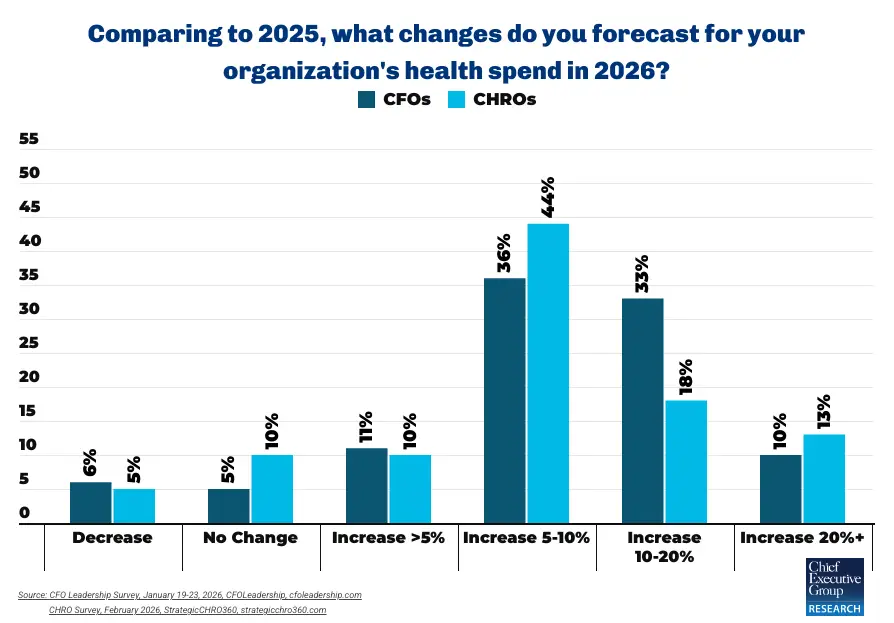

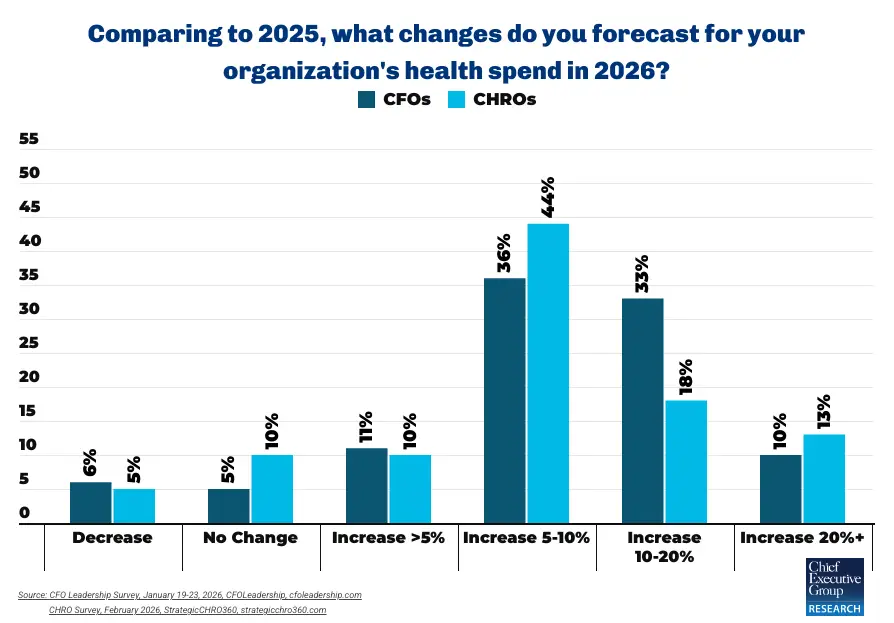

Healthcare premiums are rising sharply in 2026, yet many executives say they lack the leverage and visibility to manage them effectively.

Given tariff and regulatory uncertainties, finance leaders would be wise to take an incremental approach to new technology, advises GreyOrange CFO Guido Frantzen.

Chris Merwin of Mark43 shares how the company helps modernize public safety systems and operations through cutting-edge cloud-native services.

One characteristic is critical, says Charlotte Colhoun, Group CFO of Vista Global.

Healthcare premiums are rising sharply in 2026, yet many executives say they lack the leverage and visibility to manage them effectively.

Given tariff and regulatory uncertainties, finance leaders would be wise to take an incremental approach to new technology, advises GreyOrange CFO Guido Frantzen.

Volatile times call for aligned vision and unified action, turning the sometimes-contradictory CEO-CFO relationship from a debate into a shared problem-solving exercise. Here’s how to get there.

For Sentry Equipment CFO Dave Ring, focusing on ‘agility, velocity and employee experience’ keeps the company on the right path.

‘Agility is just as important as accuracy’ today, says Momnt CFO Kevin Cooper.

One characteristic is critical, says Charlotte Colhoun, Group CFO of Vista Global.

Healthcare premiums are rising sharply in 2026, yet many executives say they lack the leverage and visibility to manage them effectively.

Given tariff and regulatory uncertainties, finance leaders would be wise to take an incremental approach to new technology, advises GreyOrange CFO Guido Frantzen.

Volatile times call for aligned vision and unified action, turning the sometimes-contradictory CEO-CFO relationship from a debate into a shared problem-solving exercise. Here’s how to get there.

For Sentry Equipment CFO Dave Ring, focusing on ‘agility, velocity and employee experience’ keeps the company on the right path.

‘Agility is just as important as accuracy’ today, says Momnt CFO Kevin Cooper.

An early look at Claude for Financial Services 2.0—and how CFOs should pilot it: ‘Finance teams that adopt early will set the pattern others follow.’

What to watch out for—and how to prepare for new demands: ‘As banks increase digital transactions, IT and cybersecurity controls are increasingly scrutinized, and gaps in data governance and system integrations often surface.’

Finastra CFO Carissa Kell on why today’s finance chiefs need to get out of their silos and provide leadership on everything from cybersecurity to communications.

Held November 13 and 14 at the Javits Center in New York City, the FATE expo talked shop for all things fintech. Here’s what to know.

From sitting on accounting boards to running networking groups for women, Stucke gives back to the profession that launched her CFO career.

‘My role involves translating the impact of regulatory and digital shifts into actionable game plans for the broader team,’ says John Schwab, CFO of the indirect tax software company.

Post-bankruptcy, CFOs must do more than just clean up the balance sheet: they have to address operational faults as well.

For Crane, CFO of Domo, real-time data access means spending less time gathering data and more time figuring out what it’s telling him.

‘Now is not the time to make big speculative moves,’ writes Thomas Allen Carver of Harren Equity Partners.

‘In trading, you make decisions with incomplete information. You learn to trust your frameworks and move fast,’ says Cin7 CFO Erik Rothschild.

Aleksandra Szuszkiewicz of Live Nite Events orchestrates sophisticated financial frameworks for high-risk, capital-intensive entertainment ventures.

In terms of protection and earnings, ‘no one ever thinks about cash—cash is the forgotten asset,’ says Ampersand CEO Kelly Brown.

A former auditor shares what’s she’s learned since becoming CFO of a community bank.

Planning is now all about forward motion with flexibility, say CFOs. But there are critical areas to focus on. Here are 5 to watch while preparing your financial strategies for the year ahead.

What to watch out for—and how to prepare for new demands: ‘As banks increase digital transactions, IT and cybersecurity controls are increasingly scrutinized, and gaps in data governance and system integrations often surface.’

Post-bankruptcy, CFOs must do more than just clean up the balance sheet: they have to address operational faults as well.

Organizational communications should be transparent. Lead with empathy while highlighting the economic reality.

The Oberon Fuels CFO talks about scaling finance, being part of the strategy conversation and her career journey in the energy industry.

Your ‘AI-powered insights’ aren’t what you think they are.

We’re finally able to win tangible benefits, says one CFO—but they won’t come automatically.

A new study from Accenture uncovers differing sentiments between CFOs and CEOs—but there is common ground on AI as the revenue generator of the future.

An early look at Claude for Financial Services 2.0—and how CFOs should pilot it: ‘Finance teams that adopt early will set the pattern others follow.’

Stop searching for the one sweeping solution to inefficiency. Here’s how to reduce digital friction and recover millions in lost revenue.

Moving from AI experimentation to real business value isn’t about technology; it’s about clarity. Four steps finance leaders can take this month to get ahead.

Stop searching for the one sweeping solution to inefficiency. Here’s how to reduce digital friction and recover millions in lost revenue.

AI powers transformation, but culture sustains it. CFOs who treat technology as a people strategy foster teams that thrive on curiosity and collaboration.

The moment is right for the finance chief who, in partnership with the CHRO, integrates talent strategy into capital planning.

‘Most technology failures aren’t software failures. They’re leadership failures, breakdowns in trust, clarity or accountability that start long before anything crashes.’

Critical as it is, AI isn’t the whole story when it comes to leveraging technology in the pivotal area of human resources. Here are some key points to keep in mind.

“If service is below you, then leadership is beyond you,” decorated U.S. Army officer LTC Oakland McCulloch told CFO Leadership Conference attendees.

COMMUNITY

Join the premier community for today’s finance leaders! Connect instantly with 2,500+ peers for advice, inspiration and solutions.

EVENTS

In-person & online live programs led by industry experts

COMMUNITY

Our chapter communities foster a unique ecosystem. The regular in-person events provide an opportunity for rich conversations, get advice from leaders and develop long-lasting connections with peers.

Insights

Be the first to know! Receive latest industry & tech news right in your inbox

Education

Training tools & resources carefully presented by world-class experts to keep you & your team ahead of the curve.

01

A 10-module training program that provides participants with hands-on experience and insights into the practical application of technologies in finance, allowing participants to implement their new knowledge immediately.

02

CFO Leadership Council hosts CPE eligible events for both members and non-members. Find a CPE eligible event to receive the credits you need.

EVENTS

The largest gathering of finance and accounting technology professionals in the country.