5 AI Trends Impacting Finance in 2026

Earlier this year, NetSuite surveyed its customers to learn more about how they’re approaching AI in their businesses. The findings showed that a majority already use some form of AI in their daily work. But what really stood out was that participants said their strongest motivator for increased AI use is integration into the systems they already use.

At SuiteWorld 2025, NetSuite unveiled its vision for integrated, practical AI. Based on these latest innovations, here are five AI trends impacting finance in 2026:

1. AI agents will become active participants in finance operations

AI is evolving beyond analysis and recommendations to become an active participant in day-to-day financial operations. AI agents, as they’re known, can interpret context, safely use company-internal data and systems, execute complex workflows, make recommendations, and continuously improve.

For example, AI agents can help take finance teams from a month-end close to a continuous close model by working throughout the month to reconcile accounts, validate entries, and flag exceptions.

For CFOs, this shift transforms how work gets done. Finance teams will move from monitoring transactions to managing outcomes, as AI agents handle more and more of the execution. The result is a faster, more resilient close process, more accurate forecasting, and greater capacity for strategic initiatives.

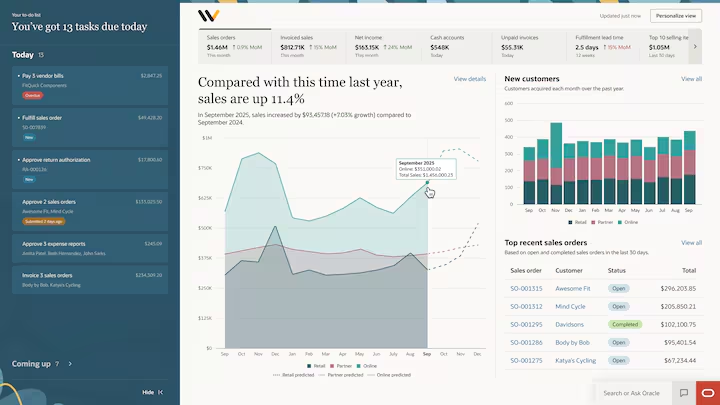

2. Natural language becomes the best way to interrogate your data

The way finance professionals interact with business systems is undergoing a fundamental shift. Natural language interfaces are replacing traditional data retrieval tools, such as SQL searches, allowing users to simply express what they need and receive tailored responses. For instance, users can simply ask, “What caused the variance in Q2 gross margin?” and receive data-backed answers instantly.

Conversations with AI assistants turn complex analytics into intuitive dialogue, democratizing access to financial insights across the organization.

3. AI becomes contextually aware, personalizing how it helps you

AI systems are becoming deeply personalized, understanding not just data but the context, preferences, and goals of each user. For finance, this means AI that knows your role, priorities, and workflows—whether you’re a controller monitoring compliance or an FP&A analyst building a forecast.

Personalized AI improves finance productivity by reducing information overload. Instead of giving generic answers and volumes of data to consider, it gives you answers that are tailored, relevant, and in step with what you’re doing at that moment.

4. AI moves beyond structured data

Traditional business systems have been limited to processing structured data, such as transactions, and other records all set up with predefined fields. A significant shift is emerging where AI can now work directly with unstructured, business-specific content including contracts, policies, institutional knowledge, customer testimonials, training guides, and more.

Instead of manually searching through shared drives for a vendor contract or trying to remember which policy document contains specific approval thresholds, finance team members can simply ask questions and receive answers drawn from both their structured financial data and their document repositories.

5. AI provides transparent and explainable answers

As AI takes on a larger role in finance, transparency and explainability are non-negotiable. Finance leaders need to understand why AI came to a conclusion and what information it used in the process.

The emphasis on transparency and explainability reshapes how finance teams evaluate, adopt, and govern AI tools. Organizations will favor platforms that have interpretability and auditability baked into their design, so finance leaders can better determine the accuracy of AI’s results and present its findings to board members, auditors, and regulators. With the ability to drill down into sources, finance teams can avoid the pernicious black box AI issue.

These trends aren’t theoretical—they’re showing up in the next generation of business systems. Finance teams evaluating AI solutions should look for platforms where these features are integrated from the ground up, not added as afterthoughts.

The biggest announcement from SuiteWorld 2025, NetSuite Next represents the future of NetSuite. AI will improve finance operations by providing deep contextual insights using all your data, with autonomous agents, and natural language search built directly into your workflow. No more context-switching between tools or exporting data to analyze elsewhere. Just AI working for you, exactly where you need it.

Want to learn more? Explore how NetSuite Next is putting AI to work for businesses here or catch SuiteWorld on demand to see these innovations in action.