Any opinions are the author’s own.

I have been in the financial world for my entire career, starting at Prudential in their M&A division. I then ventured out on my own, launching a PE firm focused on distressed companies. Essentially, I restructure struggling companies into efficient and profitable assets.

Debt, when appropriately used in a stable economy, can create game-changing opportunities. On the other hand, misused, especially in an unstable economy, debt can destroy an otherwise great company.

The harsh reality is that debt is a dangerous tool. I personally like it, but I also understand it, and my risk tolerance is probably far higher than most. I’m also using debt with a safety net. What that means is that I have my own money and investors’ money, so I can make a much more measured and non-emotional decision.

Incurring Debt

The secret to using debt effectively is multifaceted.

The most important part, of course, is making sure the business can service the debt even if it faces a significant reduction in revenue—a potential scenario for any company in a slow economy.

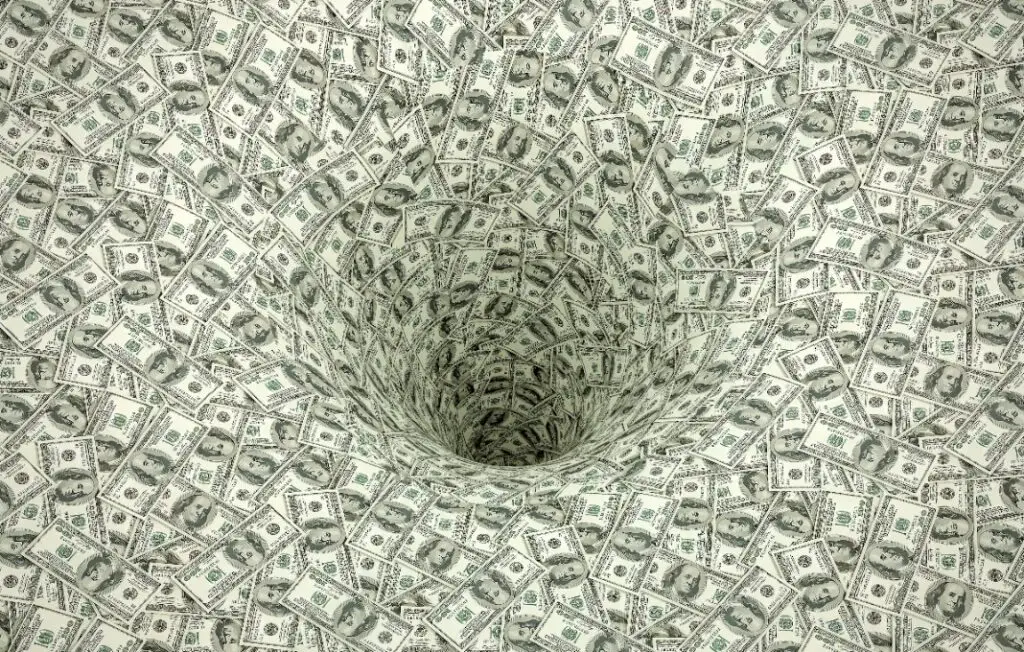

Far too many executives have made the mistake of assuming they would be immune to market conditions because of market dominance, proprietary technology or, more often than not, sheer arrogance. Unfortunately, when the tide turns, those who don’t manage their debt properly frequently find themselves sucked into a death spiral of payments they can no longer afford. That triggers collection activities that decimate the company and force it into bankruptcy.

A CFO can avoid this situation by adopting an almost “startup” mentality, where every expense is carefully analyzed. If it’s not an absolute necessity, you should avoid incurring additional debt in today’s economy.

Beyond that, you need to use debt only in very particular scenarios.

For example, now is not the time to make big speculative moves. Instead, use debt for opportunities that are near certain (or as near certain as possible) to provide a positive return on investment. One use case that fits the criteria would be the purchase of raw materials or equipment needed to fulfill a large order from a financially stable customer that is unlikely to default or pay slowly.

A more speculative use case would be to acquire a competitor with an established customer base and consistent cash flow—especially if your company can leverage existing operational efficiencies to do the work at a higher profit margin. You need to approach this very carefully, though, because there could be hidden landmines in the target business. The key is to conduct thorough due diligence to ensure you fully understand what you’re getting. An acquisition can be a transformational opportunity, especially in a volatile economy, but only if you approach it strategically and cautiously.

Persuading Lenders

When trying to land debt funding, the key is to understand what the lender or lenders are looking for and to tailor your presentation to provide the information they’ll be looking for, in the way they want to see it. Beyond that, you need to show them why your company is not just a safe investment but a good one. Frame it from their perspective, clearly demonstrating how it benefits them and aligns not only with their business but also with their other clients and initiatives. Understanding the lender’s needs and concerns will set you apart from almost every other borrower out there.

Borrowers need to understand, for example, that lenders have a different risk profile. Let’s say their upside is 7 percent and their downside is losing everything. That’s different from an equity investor, who also runs the risk of losing everything but has unlimited upside.

Remember also that, as a CFO, probably close to 100% of the time, you have more information about your business and even your industry than the lender ever will. That does not mean to lie or in any way mislead anyone.