After an abrupt 16 percent slide in confidence in the second quarter, mainly driven by President Trump’s Liberation Day announcement, America’s CFOs are reporting growing apprehension over the impact Trump’s tariffs will have on the U.S. economy—sending our CFO Confidence Index down to multi-year lows.

Tariffs going into effect last week have done little to alleviate CFOs’ concerns or uncertainty over how they will impact businesses across the U.S.

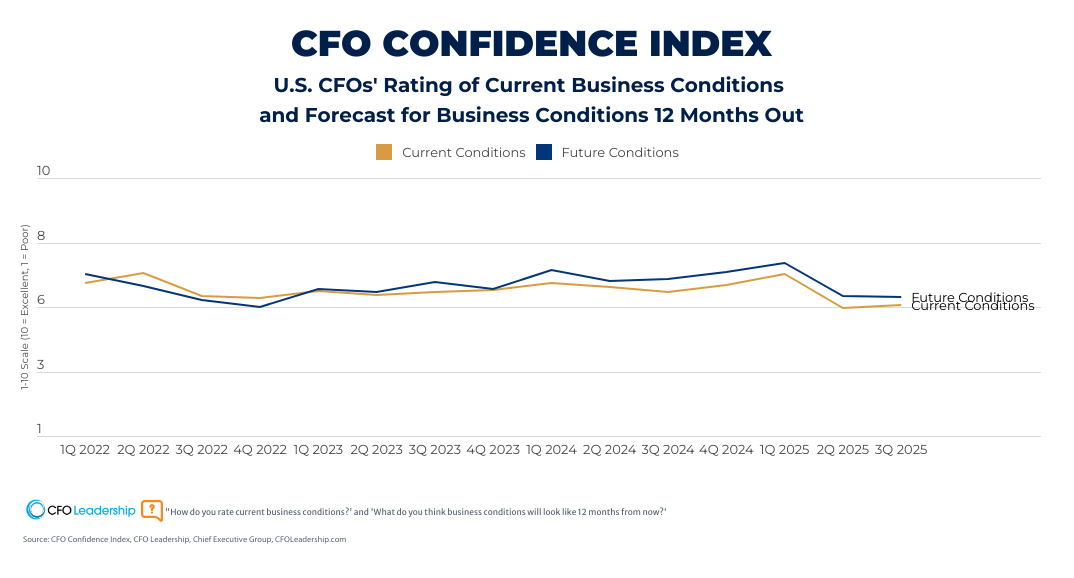

Just-released data from our third quarter CFO Confidence Index, conducted August 5 to 7 among 147 CFOs, finds their rating of current business conditions stalled at 5.5 (measured on a 10-point scale where 1 is Poor and 10 is Excellent)—the lowest level on record since the inception of the Index in 2020.

“While the tariffs picture is solidifying, the impact and timing are still a bit unclear,” explained one CFO survey participant. “It is known that it will increase costs, but the extent to which companies will bear the cost or pass it along is not entirely transparent.”

Looking Ahead

Forecasts for how that will evolve over the next year don’t provide much relief either: While CFOs anticipate a slight uptick in conditions, to 5.7 from 5.5, the 12-month projection is lower than what they had forecasted in Q2 (5.9).

It is also the lowest business conditions number since the fall of 2022, when CFOs were concerned that persistent inflation and the Fed’s tightening policy would increase the chances of a recession in the near term.

Most CFOs agreed that the overall humdrum outlook stems primarily from federal government decisions—from tariffs, regulatory and legislative uncertainty, to fiscal policy and macroeconomic decisions. One consumer manufacturing CFO also pointed to overall government debt levels: “They will begin to impact at some point,” he says.

“Primary concerns are the political and economic climate,” says one CFO, also noting changes in consumer behavior. “We service national retail brands; the activity has softened.”

Beyond the tariff levels themselves, the volatility in implementation has also thrown companies off-course. As one CFO explains, “Inconsistent policies [are] leading to business strategy errors and loss of world market demand.”

And while the volatility of the government’s trade policy may be settling as new agreements are signed and official tariffs go into effect, the longer-term impact of it all remains to be seen. “I think there will be a delayed macroeconomic [effect] forcing companies to lay off people, which will further erode consumer confidence,” says one CFO.

Still, all those concerns did not revive recession fears among CFOs—contrary to what our sister publication Chief Executive observed in its polling of CEOs last week.

Instead, 51 percent of polled CFOs expect economic growth into 2026, double the proportion who had forecasted the same in the second quarter. Only 22 percent now say they expect a slowdown or a recession in the near term, down from 47 percent last quarter.

Overall, 43 percent of the CFOs project improving business conditions one year from now, down from a majority of 51 percent in Q2. Instead, 33 percent expect conditions will worsen, vs. 29 percent in Q2, and 24 percent forecast more of the same by this time next year, up from 19 percent in Q2.

The Year Ahead

When asked about how the economic climate will impact their respective companies, CFOs appeared more optimistic, with unwavering 12-month forecasts.

- 70 percent forecast revenue to increase in 2025, compared with the prior year (vs. 72 percent in Q2)

- 57 percent expect profits to increase (vs. 52 percent in Q2)

CFOs say this is mainly due to healthy backlogs, with some assistance in generating new efficiencies from AI. “Lots of opportunities and good backlog of work for us,” says one CFO, though noting he is keeping an eye on trade developments.

But, as one CFO put it: “As long as your business isn’t involved in international import of goods, I don’t foresee a change to domestic businesses.”

This is perhaps why CFOs appear undeterred in their plan to deploy capital over the coming months:

- 48 percent plan to add to their headcount (vs. 49 percent in Q2)

- 38 percent plan to increase their capex this year (vs. 35 percent in Q2)

- 45 percent intend to add to their cash position, while 20 percent are increasing their debt levels (both unchanged since Q2)

About the CFO Confidence Index

Every quarter, CFO Leadership surveys hundreds of CFOs across America at organizations of all types and sizes to inform our CFO Confidence Index, a real-time and forward-looking tracker of CFO confidence in current and future business environments, as well as their forecast for their company’s revenue, profit, capex and cash/debt ratio for the year ahead. Learn more at CFOLeadership.com/cfo-confidence-index/